London Capital & Finance - A Scam or Very Tangled Web of Companies?

Previously it was discovered that London Capital & Finance had been repeatedly using a loophole to avoid publishing their accounts. By reducing the accounting period it meant they had another 3 months to submit accounts, do this a few times and the date gets longer and longer. It now appears that there may have been more reasons to do this after the FCA started investigating them.

A further update on where London Capital Finance loans went is here and How LCF spent your money and will I get money back?

One of the posters on MoneySaving Expert forums came up with some very interesting information about London Capital Finance (LCF) and the loans that they have made. It appears that at least some of these loans have been made to connected companies registered at the same address and by the same directors as the ones that run London Capital Finance.

The key director that is the common theme across the companies is Robert Mannering SEDGWICK who is a director of 40 companies, many apparently connected with LCF at Wellington Gate, 7-9 Church Road, Tunbridge Wells, Kent, England, TN1 1HT.

There are a number of these companies that have borrowed money from LCF and have a charge on their accounts from it.

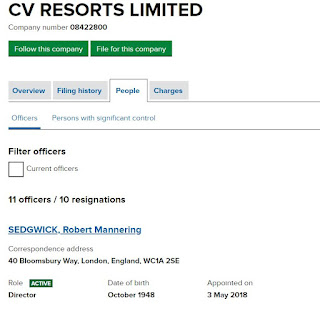

CV RESORTS LIMITED, Company number 08422800

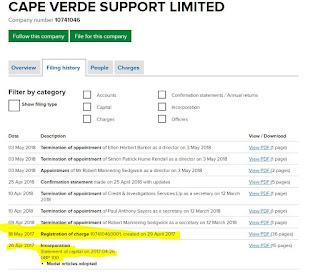

Another one is CAPE VERDE SUPPORT LIMITED, Company number 10741046

The item that consists of the Fixed Assets of CV Resorts is unclear but seems to have appeared in their accounts for year ending 30 Sept 2015 as a revaluation item. There is no comment or detail as to what the company owned that has suddenly been revalued to be worth £28 million pounds that wasn't in their accounts before.

In addition if the money has been lent to a company and then lent on again to someone else the ability to access that money and claim on it becomes diminished as the ultimate company that has the money has no liability to LCF and their bondholders. The charge that LCF has put on the assets for the original loan is worthless as the money has gone.

Another linked company is Costa Property Holdings Ltd that has yet another charge from LCF on its company. However the accounts produced after the charge was registered shows the assets of the company are only £10,000. This is substantially less than the minimum loan LCF claim to offer of £500,000 meaning the charge is presumably worthless.

The owner of many LCF linked companies is London Power Management 02504629 which owns

LEISURE & TOURISM DEVELOPMENTS LIMITED which in turn owns CV RESORTS LIMITED

These have SEDGWICK, Robert Mannering as a director but which ones owe money to LCF?

If you look into the details of London Power Management it seems to have an interesting history with many names but more importantly it hasn't filed accounts since 2015 and is in the process of being struck off. This company seems to be the ultimate owner of the assets used by LCF as collateral for the loans that have been made.

Another LCF connected company with linked directors LONDON FUTURE ENERGY LIMITED, Company number 10895361 was setup in 2017, Global Security Trustees had significant control but the company was dissolved in August 2018 without any accounts ever being filed. Was this company lent money by London Capital & Finance?

https://beta.companieshouse.gov.uk/company/10895361/filing-history

A further update on where London Capital Finance loans went is here and How LCF spent your money and will I get money back?

One of the posters on MoneySaving Expert forums came up with some very interesting information about London Capital Finance (LCF) and the loans that they have made. It appears that at least some of these loans have been made to connected companies registered at the same address and by the same directors as the ones that run London Capital Finance.

The key director that is the common theme across the companies is Robert Mannering SEDGWICK who is a director of 40 companies, many apparently connected with LCF at Wellington Gate, 7-9 Church Road, Tunbridge Wells, Kent, England, TN1 1HT.

There are a number of these companies that have borrowed money from LCF and have a charge on their accounts from it.

CV RESORTS LIMITED, Company number 08422800

|

| Robert Mannering SEDGWICK Director |

Another one is CAPE VERDE SUPPORT LIMITED, Company number 10741046

You have to wonder about the quality of the London Capital Finance lending criteria when Cape Verde Support Ltd were incorporated as a company on 26 April 2017 and 3 days later LCF already had a charge applied to the company.

|

| Cape Verde Support Ltd - London Capital Finance charge |

Due to the company being new there are no accounts available to show the details of the loan that they took out. The LCF memorandum claims an extensive process to verify P&L for borrowers - quite how that is possible for a brand new company is unclear.

The interesting thing is that CV RESORTS LIMITED accounts show that they are owned by Leisure & Tourism PLC and have a revaluation reserve of £23 million but their latest accounts include the following disclaimer "there has been a permanent impairment of the value of Fixed Asset investments with resulting diminution of the Revaluation Reserve. Directors should be able to quantify in due course"

The item that consists of the Fixed Assets of CV Resorts is unclear but seems to have appeared in their accounts for year ending 30 Sept 2015 as a revaluation item. There is no comment or detail as to what the company owned that has suddenly been revalued to be worth £28 million pounds that wasn't in their accounts before.

|

| Fixed Assets of CV Resorts |

Does London Capital & Finance actually have any assets that can be recovered?

This is a really important point. If London Capital & Finance have lent via a web of other companies to one where the supposedly guaranteed security for the loan is the fixed assets of that company AND that company has now said that the value of the fixed assets are significantly reduced then that means that London Capital & Finance no longer have the assets to back up their loan. Should the company go bust then there will be little in the way of assets available to distribute to the bond holders of London Capital Finance.In addition if the money has been lent to a company and then lent on again to someone else the ability to access that money and claim on it becomes diminished as the ultimate company that has the money has no liability to LCF and their bondholders. The charge that LCF has put on the assets for the original loan is worthless as the money has gone.

Another linked company is Costa Property Holdings Ltd that has yet another charge from LCF on its company. However the accounts produced after the charge was registered shows the assets of the company are only £10,000. This is substantially less than the minimum loan LCF claim to offer of £500,000 meaning the charge is presumably worthless.

The owner of many LCF linked companies is London Power Management 02504629 which owns

LEISURE & TOURISM DEVELOPMENTS LIMITED which in turn owns CV RESORTS LIMITED

These have SEDGWICK, Robert Mannering as a director but which ones owe money to LCF?

If you look into the details of London Power Management it seems to have an interesting history with many names but more importantly it hasn't filed accounts since 2015 and is in the process of being struck off. This company seems to be the ultimate owner of the assets used by LCF as collateral for the loans that have been made.

The companies that it owns are shown as the following in 2015. As there are no more recent accounts we have no knowledge how this has changed in the last 3 years

Finally it appears that the registered address of some of the LCF linked companies has been changed to 40 Bloomsbury Way, London, England, WC1A 2SE at the end of 2018. This is just after the Financial Conduct Authority started an investigation into LCF - any connection?

Another LCF connected company with linked directors LONDON FUTURE ENERGY LIMITED, Company number 10895361 was setup in 2017, Global Security Trustees had significant control but the company was dissolved in August 2018 without any accounts ever being filed. Was this company lent money by London Capital & Finance?

https://beta.companieshouse.gov.uk/company/10895361/filing-history

I am following the activities of a dubious set of companies. Sometimes money is transferred between companies and then the company that it was transferred to dissolves before any accounts are submitted to Companies House. It isn't clear where the money goes when the company dissolves. Is this common practice?

ReplyDelete