The main borrower from London Capital & Finance was a company called London Oil and Gas which borrowed an eye watering £122 million from LCF - over half of the money that was collected from investors and certainly didn't tie in to the LCF claims of spreading lending across many companies. LCF went into administration in early 2019 and London Oil and Gas followed shortly afterwards.

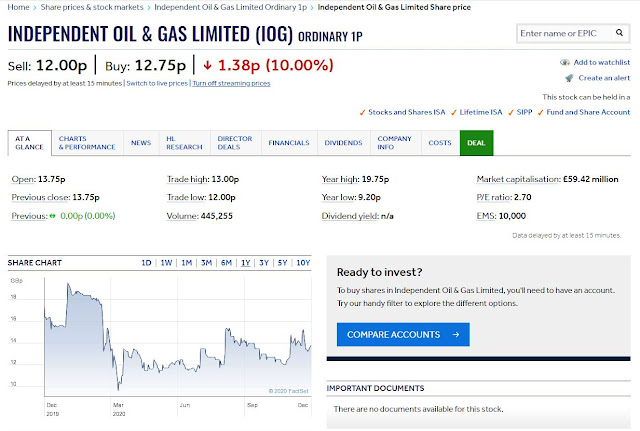

Aside from some very speculative or potentially dubious investments that London Oil and Gas made with their borrowed money the main asset remaining is in a company called Independent Oil & Gas (IOG) which is developing oil and gas fields and networks in the North Sea. IOG is a legitimate company that is listed on the London Stock Exchange and as a result the value of the investment in it can easily be calculated from the daily share price.

There are 2 parts to the assets owned by London Oil & Gas in IOG. Parts of the loan were in exchange for shares and warrants in Independent Oil & Gas. Warrants are similar to shares in that they can be traded and give the holder the right to buy shares in a company at a certain price agreed at the start. This can make the warrants in a company much more volatile than the shares because they are subject to gearing as a result of the difference between the warrant price and the share price.

For example if shares in IOG were 10p each and you owned warrants that gave you the right to buy shares in IOG for 5p each then if you owned a warrant you could make 5p profit on every share that you bought with the warrant.

In that instance the warrant value would be somewhere between 1p and 5p, it wouldn't go above 5p because rather than buying the warrant at 5p and then buying the share for another 5p you could just buy the shares directly at 10p.

For simplicity if we assume initially that the warrants are trading at 5p and the shares are 10p. Over time the shares increase to 15p so they have risen by 50%. The warrants still give you the ability to buy the shares for 5p so they will also increase in value, say to 10p. This is an increase of 100% in the warrant price which shows the impact of gearing. In reality the warrant price will not move like this and other factors will come into play such as the duration of the warrants and the differential between the warrant price and the share price.

London Oil & Gas have a number of warrants for the shares in IOG and recently exercised some of these to buy new shares in IOG. At the same time the LOG administrators also sold some shares they already own in IOG to fund this.

The other and possibly equally important reason is that LOG already holds substantial assets in IOG and would need to use existing cash to invest more money into IOG shares. It is likely that this would not be seen as a good use of administration funds when the administrators are meant to be realising assets to repay the LCF loans not buying more shares that will make that process more difficult.

LOG still have more warrants in IOG that expire on 31/12/20 that have a price of 11.9p. As the current share price is barely above this it is debatable whether these are worth exercising. There are further warrants expiring in 2023 that LOG also own and these will also have a negative influence on the IOG share price with additional shares being added if they are exercised.

Details of the lending to IOG from LOG are shown in their accounts

|

| IOG borrowing from LOG/LCF |

|

| IOG borrowing from LOG/LCF total of £38.55m |

Comments

Post a Comment