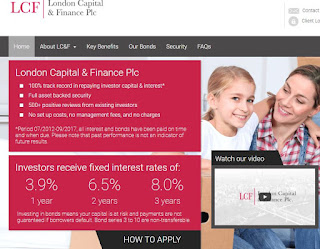

Savings Explained - Is it an Investment Scam?

Update - as of March 2020 the Savings Explained website is now offline. Hopefully they didn't attract too many people with their misleading adverts. A new website called Savings Explained has been marketing on Facebook and printed media recently. Despite the name it doesn't seem to be doing much to explain savings and if anything is making the situation more confusing with their adverts They claim " Savings Explained was founded with one basic aim – to make savings less complicated" If that's the case why are they advertising high risk, unregulated investments from what appears to be a linked company alongside regulated FSCS protected investments. It doesn't suggest that Astute Capital and Savings Explained are a scam but they certainly aren't being very transparent or explaining the risks of investing when they are promoting themselves as SAVINGS explained but plugging investments where your capital is at risk. Savings Explained reviews