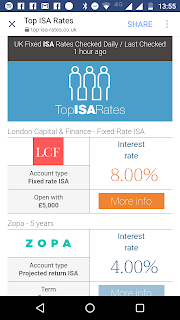

LCF Letter to Bondholders from Administrators

Dear Sir / Madam, London Capital & Finance Plc (in administration) (‘LCF’) We are writing to you, as you are a Bondholder of LCF. On 30 January 2019, LCF entered into administration. Finbarr O’Connell, Adam Stephens, Colin Hardman and Henry Shinners of Smith & Williamson LLP were appointed Administrators of LCF. This email has been written by the Administrators to you to update you on the position with regard to the administration of LCF. There has been some press and social media comment about LCF and LCF’s prospects in recent weeks but we appreciate that the fact that LCF has gone into administration is likely to come as a shock to you. We are very mindful of Bondholders’ (and other creditors) understandable concerns about the current situation. What we are doing Our work is at an early stage. We are already working with the Company’s existing staff and LCF’s borrowers to ascertain what needs to be done in order to maximise the returns to the Bondholders. We are especially fo