Cauta Capital Bond Repayment Missed Deadlines

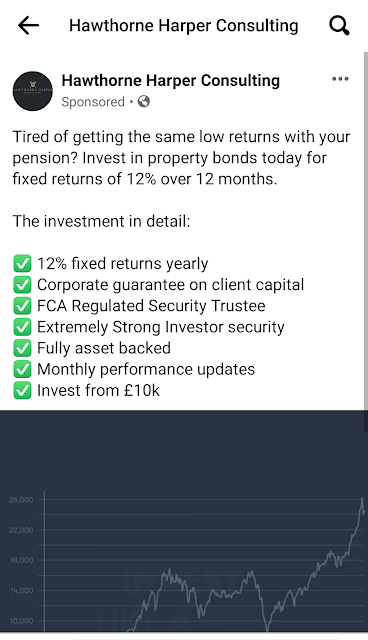

How to get money back from Cauta Capital Bonds? I wrote about Cauta Capital and the risks of investing money with them back in 2019. Sadly some of the investors in Cauta Capital are now finding out the true risks to their bond capital as repayment dates have been missed and they've apparently had erratic interest payments along the way too. Cauta were offering unrealistic interest rates of 11% on their bonds and had no mention on the adverts of the risks involved in lending money to a small startup company in the way of unregulated bonds. As with Fluid ISA Bonds investing money in an unregulated company gives you very little in the way of options to recover your money if the company go bust or stop answering your calls or emails. The money with Cauta Capital is not protected by FSCS or FCA regulated so if the company fails to pay then investors would only be able to take legal action themselves to force a return of their capital. If the company has no assets then this would be fu