21st Century Regulation Failures

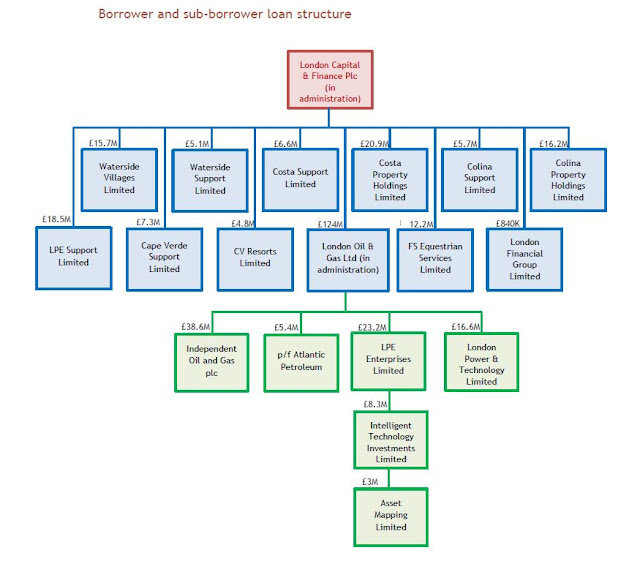

You'd expect that in the 21st Century as we become more knowledgeable with much better access to information and scientific advances that we would avoid obvious failures with regulations being ignored but again this week it's clear that isn't happening. 21st Century Regulation Failures Any followers of this blog will be well aware that the London Capital & Finance failure shows the complete lack of effective regulation by the Financial Conduct Authority in the UK to protect savers from losing money to investment scams. To have nearly £250 million of savers money invested in an unregulated investment company that could claim to be regulated and market their products as safe ISAs when the money was being systematically siphoned from the company is an appalling reflection on the state of our financial regulations. It appears that it isn't just the FCA that is at fault but that the auditors of the company also failed to highlight that LCF was technically insolven...