LCF Administrator Report Key Points - Fraud & Little Money Left

Smith & Williamson have released their proposals for the administration of London Capital and Finance. There are a few key takeaways that I've seen from the report that backs up many of the finding that have been posted in this blog over the last 3 months. The real shock is how much blatant fraud appears to have taken place and the fact that almost everything that LCF claimed was actually lies. No security for loans, no due diligence, no 200 companies lent money.

They have confirmed that they estimate a return as low as 20% of the money that bondholders invested in LCF so for a £10,000 bond you would only get £2,000 back.

They have confirmed that they estimate a return as low as 20% of the money that bondholders invested in LCF so for a £10,000 bond you would only get £2,000 back.

- Loans made with no security for them and little chance of repayment

- Interest payments from borrowers ceased in Sept 2018. LCF were still claiming no defaults even at Dec 2018

- Loan of £12 million made to a company with no bank account

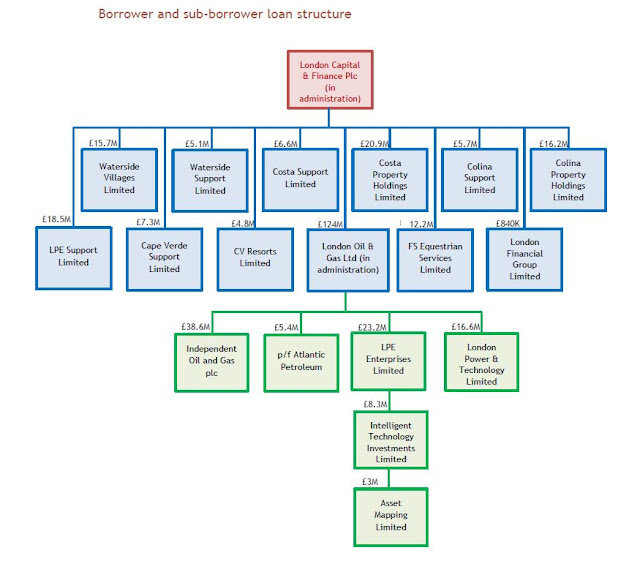

- Loans made to only 4 groups of companies

- One company group was loaned a total of nearly £155m, a massively risky proposal

- Total bonds of £237 million does not match the total company balance sheet of £202 million

- Sale of land/shares by 4 individuals with proceeds ending up in their personal bank accounts

- £107 million paid into LCF ISAs from December 2017 to Dec 2018. Subsequently HMRC voided these ISAs

- Management of various borrowers are being "completely unhelpful"

- 2 Possible options for FSCS claims

If the loans made by LCF had no benefit to the bondholders and only served to enrich the orchestrators, surely the whole thing is not an investment gone but simply a scam?

ReplyDelete