Are Top ISA Rates Too Good To Be True? Best ISA rates Review

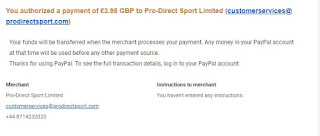

Are Top ISA Rates Too Good To Be True? If you search on Google for "top ISA rates" or "best ISA rates" then one of the promoted adverts and sometimes one of the high ranking results is a website called Top ISA Rates. Are Top ISA Rates Too Good To Be True? Best ISA rates Review If you click through and look at the products advertised on the Top ISA rates website then you will see a variety of products listed but no differentiation on their risk or status. Worryingly their website states "Fully secured ISAs. Types: Fixed Rate Interest, High Rate Of Interest, Full Security." This is incorrect as the products listed as not fully secured or having full security. They are products where you can lose 100% of your money. Until recently the main product they promoted was a company called London Capital & Finance . However this company is now being investigated by Financial Conduct Authority and is not allowed to promote for new business or move any ...