Is Hawthorne Harper Consulting Genuine? Pension Investment Review

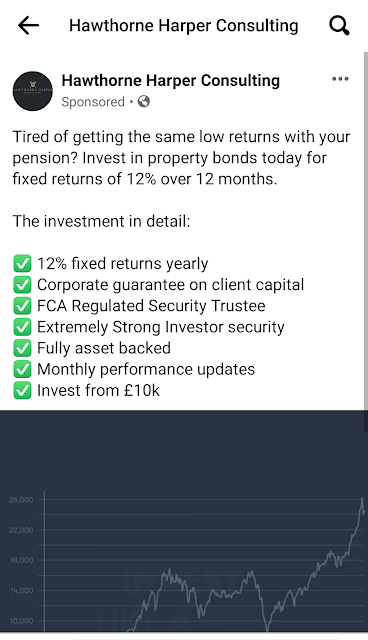

Adverts for Hawthorne Harper Consulting are appearing on Facebook targeting pensioners suggesting that you can get:

- 12% fixed returns yearly

- FCA regulated trustee

- Fully asset backed

- Corporate guarantees

If this list looks familiar then it may be because London Capital and Finance used many of the same phrases when advertising their mini bonds. The key information missing is that your capital is at risk and that it is not FSCS protected. A regulated trustee does not guarantee that the investment will return your capital.

If you search the FCA register to check if Hawthorne Harper Consulting are registered with the FCA you will find no entry for them or for their company name Willow & Blake Associates Ltd. This means they are not authorised by the FCA to sell savings or investments to UK consumers.

|

| Hawthorne Harper Consulting review |

This advert has been reported to the FCA as being misleading and not complying with their requirements that unregulated investments must not be sold to inexperienced investors. There is no warning of the risks on this advert so it could tempt unwary savers to invest their pension money without understanding the risks involved.

If you are wanting to check if Hawthorne Harper Consulting is a genuine company then you may want to check who you are dealing with and what investment you are actually being sold. Hawthorne Harper Consulting is the trading name of a company called Willow & Blake Associates Ltd which was formed in 2013 and is run by someone called Laura Jones based in Gravesend, Kent. Their latest accounts show a loss for 2020.

Hawthorne Harper Consulting appears to be an introducer or intermediary that sells bonds on behalf of other companies. No details of the bonds being sold are given but any bond offering 12% interest is going to be higher risk and is not a mainstream product.

There is no detail given on the fees that Hawthorne Harper Consulting are charging for arranging these investments but anyone looking to invest their money should be very clear how much it is costing. As an example London Capital & Finance and Blackmore Bond were paying introducers as much as 25% for investors that took out their bonds so a substantial amount of investor money was never actually invested.

The Facebook advert suggests that you can get far higher returns with Hawthorne Harper than with your pension which is a misleading claim and not comparing like with like. Most pension investments are regulated so you have some protection and there are literally thousands of possible pension options so to suggest their return is better can't be validated . Pension investments may not offer fixed returns of 12% but equally they also don't carry the risk of losing ALL of your money that unregulated options do.

The Facebook advert makes no mention of any risk warnings or of the fact that the investment is not covered by the FSCS. Unlike Facebook the Hawthorne Harper Consulting website however states the following:

The content of this promotion has not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000. Reliance on this promotion for the purpose of engaging in any investment activity may expose an individual to a significant risk of losing all of the property or other assets invested.

With unregulated investments there is no guarantee that you will get some or any of your money back. You have no protection from the FSCS and no route to compensation.

There is no suggestion that Hawthorne Harper Consulting is a scam or that you will lose your money but you should be aware that as with any unregulated investment there is a distinct risk that could happen as you are lending money to a company that may be unable to pay it back even if there are assets available.

If you have any doubts about an investment opportunity or whether it looks too good to be true then it would be advisable to speak to an Independent Financial Adviser who will be able to offer fully regulated advice on the investments available.

Please can I have some contact details regarding this post please. As a Director of this company trading for over 9 years I would like to speak to the person who wrote this. My Solicitor has reviewed and advised we are legally correct requesting the post is deleted given its misleading

ReplyDelete