Blackmore Bond Administration Finally Happens

It's taken almost a month from my previous post suggesting the administration for Blackmore Bond seemed to be inevitable and it's finally happened. Investors have not received their interest payments and now are looking at possible capital losses although the amount of recovery is yet to be determined.

https://damn-lies-and-statistics.blogspot.com/2020/03/blackmore-bond-administration-inevitable.html

Oak Trustees has appointed Duff & Phelps as administrators to manage the company and in their notice of doing so there are a couple of points for investors that are rather worrying.

1) Blackmore Bond have failed to be transparent with the trustees (no surprises there as Blackmore have still failed to file their 2019 accounts or to produce the accountant's report of the situation repeatedly promised)

2) It appears that Blackmore have taken out loans against properties in the last couple of months.

In the Trustee’s letter to Bondholders dated 16 April 2020 the Trustee noted (at paragraph 1.10) that various loans and accompanying security had been entered into by certain subsidiaries of PLC during February and early April 2020 which may impact the security position of the Bondholders. The Trustee also noted (in paragraph 2.3 of the previous update) that it was raising queries with PLC in relation to the ownership of certain development sites, as well as security granted in February 2020 in connection with a number of such sites. Having made enquiries the Trustee considers that entry into this new security was potentially detrimental to the interests of the Bondholders and represented a failure by PLC to be transparent in its dealings with the Trustee.

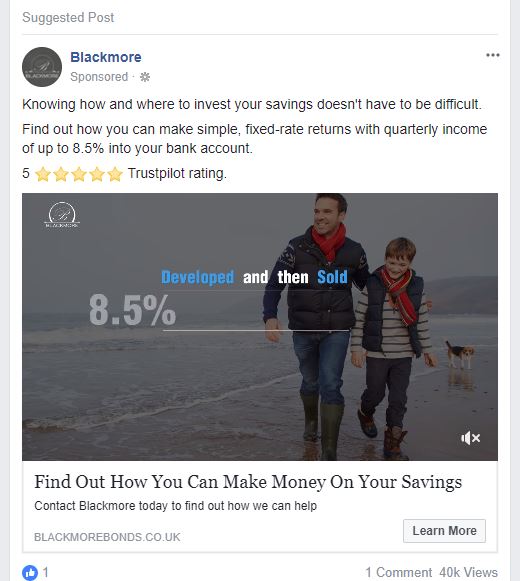

It's all a far cry from the Blackmore adverts promising simple fixed returns equating them to bank accounts.

https://damn-lies-and-statistics.blogspot.com/2020/03/blackmore-bond-administration-inevitable.html

Oak Trustees has appointed Duff & Phelps as administrators to manage the company and in their notice of doing so there are a couple of points for investors that are rather worrying.

1) Blackmore Bond have failed to be transparent with the trustees (no surprises there as Blackmore have still failed to file their 2019 accounts or to produce the accountant's report of the situation repeatedly promised)

2) It appears that Blackmore have taken out loans against properties in the last couple of months.

In the Trustee’s letter to Bondholders dated 16 April 2020 the Trustee noted (at paragraph 1.10) that various loans and accompanying security had been entered into by certain subsidiaries of PLC during February and early April 2020 which may impact the security position of the Bondholders. The Trustee also noted (in paragraph 2.3 of the previous update) that it was raising queries with PLC in relation to the ownership of certain development sites, as well as security granted in February 2020 in connection with a number of such sites. Having made enquiries the Trustee considers that entry into this new security was potentially detrimental to the interests of the Bondholders and represented a failure by PLC to be transparent in its dealings with the Trustee.

It's all a far cry from the Blackmore adverts promising simple fixed returns equating them to bank accounts.

|

| Blackmore Bond Administration Finally Happens |

Comments

Post a Comment