LCF Collapse - Spotlight on Robert Sedgwick of Buss Murton Solicitors (London Capital & Finance Ponzi)

Update 28 November 2024:

Robert Sedgwick is among the defendants found to be liable for the collapse of London Capital and Finance after a trial lasting many months. The court found that LCF was a Ponzi scheme and Sedgewick was involved in the deception. He refused to give any evidence in the court case and the judge found this inferred negatively against him as a result. The judge found there were many areas where he was directly involved in actions to extract funds from LCF that resulted in the loss of bondholders money.

Original article from 2019:

There are a number of people who have been in the news over the £237 million failure of London Capital & Finance including the famous five who have been arrested by the Serious Fraud Office (SFO) investigating the collapse of the company.

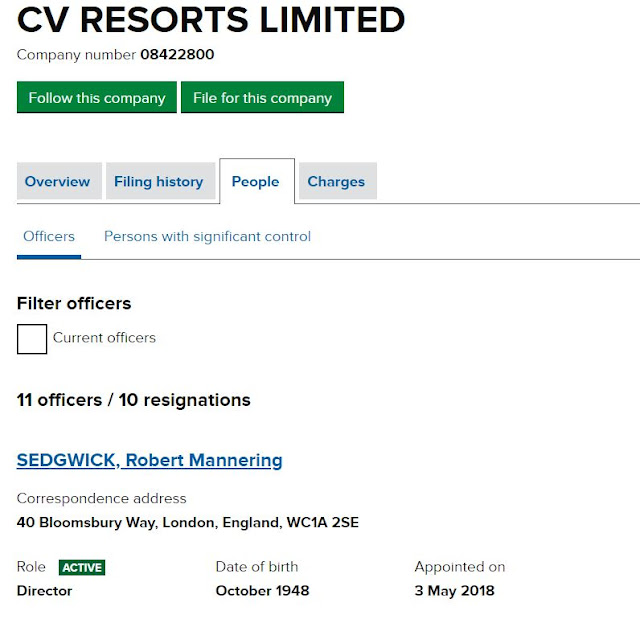

In addition to the main players there were a number of other people who helped the directors of London Capital Finance to carry out there activities. One of those was Robert Mannering Sedgwick from Buss Murton Law a firm of solicitors based in Wellington Gate, 7-9 Church Road, Tunbridge Wells, Kent. His name and their details appear on many of the documents produced to support the loans taken out between companies and he was also director of a number of the LCF related companies at different times including Global Security Trustees that was meant to protect bondholder interests. In fact he is still currently the only director of CV Resorts Ltd that borrowed £4.7 million from London Capital and Finance.

Robery Sedgwick has an interesting past despite a long career as a solicitor. In 2018 he agreed to be removed by the Solicitor's Disciplinary Tribunal for his role in a carbon credits scheme that was described as "dubious". It appears that this experience didn't enlighten him sufficiently to ask more questions of his involvement with LCF.

There are a couple of possible options, either Robert Sedgwick was involved in the LCF business and knew exactly what the company was doing or he was negligent in his role as a company director of the borrower that LCF lent money to as there appears to be no security that the company has for the loan and he has failed in his role as a director to submit accounts and confirmation statements both of which are significantly overdue from 2019.

You can read the full outcome of the Solicitor's Disciplinary Tribunal here https://www.lawgazette.co.uk/sdt-and-sra-interventions/sdt-robert-mannering-sedgwick/5065389.article

In addition to the main players there were a number of other people who helped the directors of London Capital Finance to carry out there activities. One of those was Robert Mannering Sedgwick from Buss Murton Law a firm of solicitors based in Wellington Gate, 7-9 Church Road, Tunbridge Wells, Kent. His name and their details appear on many of the documents produced to support the loans taken out between companies and he was also director of a number of the LCF related companies at different times including Global Security Trustees that was meant to protect bondholder interests. In fact he is still currently the only director of CV Resorts Ltd that borrowed £4.7 million from London Capital and Finance.

|

| LCF - Robert Sedgwick of Buss Murton Solicitors |

|

| LCF borrower - Robert Sedgwick Buss Murton Solicitors |

You can read the full outcome of the Solicitor's Disciplinary Tribunal here https://www.lawgazette.co.uk/sdt-and-sra-interventions/sdt-robert-mannering-sedgwick/5065389.article

Comments

Post a Comment