London Capital & Finance - Going Round in Circles?

When looking at the accounts for London Capital & Finance your head starts spinning as the whole setup goes round in circles. The situation with one of the companies called CV Resorts Ltd that borrowed money from LCF is a good example.

CV Resorts Ltd borrowed money from LCF but also borrowed from another company run by common directors called Cape Verde Support Ltd.

https://beta.companieshouse.gov.uk/company/08422800/charges

The charge for the loan agreement between CV Resorts Ltd and Cape Verde Support Ltd makes curious reading. A familiar name for those looking at LCF, Simon Hume-Kendall signed the loan agreement on behalf of CV Resorts Ltd, his opposite number signing on behalf of Cape Verde Support Ltd was none other than Simon Hume-Kendall so the same person was signing the contract for the lender and the borrower!

At least the witness Robert Mannering Sedgwick didn't have far to travel as all the companies were based in the same office address as him at Church Road, Tunbridge Wells, Kent. Sedgwick was part of Buss Murton Law LLP who have the offices at Church Road, Tunbridge Wells, Kent

The loan agreement to CV Resorts Ltd from Cape Verde Support Ltd was made on 29th April 2017. Communication doesn't seem to have been very good in the offices at Church Road, Tunbridge Wells or the directors were quite forgetful as shortly afterwards on 12th May 2017 other directors of CV Resorts Ltd decided to take out a loan from London Capital & Finance pledging the same assets as security that had already been assigned to Cape Verde Support Ltd for their loan on 29th April

What can London Capital & Finance bondholders expect back if all the assets have previously been pledged to another company?

CV Resorts Ltd borrowed money from LCF but also borrowed from another company run by common directors called Cape Verde Support Ltd.

https://beta.companieshouse.gov.uk/company/08422800/charges

The charge for the loan agreement between CV Resorts Ltd and Cape Verde Support Ltd makes curious reading. A familiar name for those looking at LCF, Simon Hume-Kendall signed the loan agreement on behalf of CV Resorts Ltd, his opposite number signing on behalf of Cape Verde Support Ltd was none other than Simon Hume-Kendall so the same person was signing the contract for the lender and the borrower!

At least the witness Robert Mannering Sedgwick didn't have far to travel as all the companies were based in the same office address as him at Church Road, Tunbridge Wells, Kent. Sedgwick was part of Buss Murton Law LLP who have the offices at Church Road, Tunbridge Wells, Kent

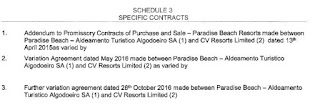

|

| Security for CV Resorts Ltd loan from Cape Verde Support Ltd |

The loan agreement to CV Resorts Ltd from Cape Verde Support Ltd was made on 29th April 2017. Communication doesn't seem to have been very good in the offices at Church Road, Tunbridge Wells or the directors were quite forgetful as shortly afterwards on 12th May 2017 other directors of CV Resorts Ltd decided to take out a loan from London Capital & Finance pledging the same assets as security that had already been assigned to Cape Verde Support Ltd for their loan on 29th April

|

| Loan security for CV Resorts Ltd loan from London Capital & Finance |

What can London Capital & Finance bondholders expect back if all the assets have previously been pledged to another company?

Sweet F A is the answer

ReplyDeleteBuss Murton Law solicitors, mentioned above in the text, have a history with directors of failed companies including a dubious past carbon credit scheme which misappropriated investor monies and the recently liquidated London Capital and Finance Ltd (LCF) closed down by the FCA. One of the managing partners of Buss Murton, Robert Mannering Sedgwick, was recently suspended for a year in 2018 by the Solicitors Disciplinary Tribunal (SDT) for past involvement with a carbon credit scheme that misappropriated investor monies. This was the same managing solicitor who was the trustee for the FCA closed LCF, the CEO (Andy Thomson) and the borrowing companies of which misappropriated LCF bondholders monies. The suspended solicitor, Robert Mannering Sedgwick, shared many directorships of other companies with Andy Thomson over the years. Now according to the latest LCF liquidator's update Buss Murton Law solicitors are refusing to provide information to help the liquidators of LCF to recover lost bondholder monies. Why would BML solicitors not help the legally appointed liquidator of LCF to recover misappropriated bondholder investment money?

ReplyDelete