Is it True that LCF Borrowers Never Defaulted?

London Capital & Finance made a big thing in their literature and website that none of their borrowers had defaulted on their loans and that they had a 100% track record.

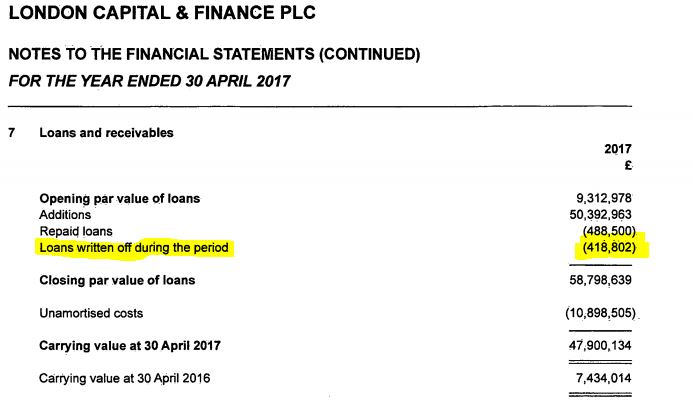

Reading their most recent accounts to 30 April 2017 might give a different picture. It's not a massive number but it indicates that loans made have been written off.

According to the accounts published at Companies House there were loans of £418,000 that were written off in the year ended 30 April 2017. This isn't a massive number as it's less than 1% of the loans outstanding but it does seem to show that LCF claims that no defaults had ever taken place are incorrect.

Also interesting from the 2017 accounts is that the directors of LCF were paid NOTHING! That's right, no director was paid any money as salary. Even the 6 employees of LCF were only paid a total of £96k between them, that's only £16k each on average including all their tax and national insurance costs. Not a massive amount!

Costs of setting up LCF bonds. It appears from the accounts that the costs of LCF paying commission and other setup costs was approximately 20% of the bond value, the same as Blackmore Bonds paid to Surge Financial.

Reading their most recent accounts to 30 April 2017 might give a different picture. It's not a massive number but it indicates that loans made have been written off.

According to the accounts published at Companies House there were loans of £418,000 that were written off in the year ended 30 April 2017. This isn't a massive number as it's less than 1% of the loans outstanding but it does seem to show that LCF claims that no defaults had ever taken place are incorrect.

|

| LCF Directors salaries 2017 |

Costs of setting up LCF bonds. It appears from the accounts that the costs of LCF paying commission and other setup costs was approximately 20% of the bond value, the same as Blackmore Bonds paid to Surge Financial.

Comments

Post a Comment