LCF Administrators - New Claims Made

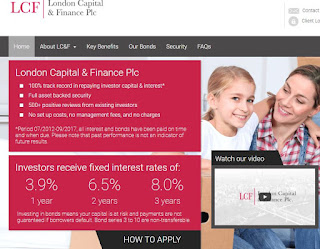

The excellent Bond Review blog had a good summary of the initial impression that Smith & Williamson administrators made when they began their work on London Capital & Finance. Some additional information has since emerged from various discussions between the administrators and the owner of a LCF Bondholder Facebook group.

In the summary provided on the Bondholder Facebook group there are some quite startling claims that Finbarr O'Connell has apparently made. S&W have been contacted for comment and I'm awaiting confirmation from them that the statements attributed are correct.

Two claims in particular raise significant questions, firstly a suggestion that problem was that LCF had grown too fast and were trying to recruit a finance director to file their accounts and secondly a statement that LCF had paid Surge Financial (the company that marketed and handled the customer contacts for LCF) money to underwrite the loans.

This is quite an intriguing suggestion that has not previously been mentioned in any information about LCF. It would be interesting to know if this is backed up or if it is a misunderstanding of the conversation from someone who isn't expert in financial matters.

If the payments made to Surge Financial were for underwriting loans instead or as well as commission for sale of bonds then it may make little difference or it could create another avenue of liability for investors to pursue.

This is a sensible idea in theory to avoid any negative publicity that may affect the companies that have borrowed money from LCF. However it ignores the fact that 2 of those companies are publicly listed on stock market and have already released statements of their own to the stock market and press. It also fails to recognise that those 2 companies have NOT borrowed from LCF themselves, they borrowed from a company that itself borrowed from LCF.

This statement also fails to mention the other "non trading" companies that appear to have had no activity on their accounts for the last 3-4 years

|

| LCF Administrators New Claims |

In the summary provided on the Bondholder Facebook group there are some quite startling claims that Finbarr O'Connell has apparently made. S&W have been contacted for comment and I'm awaiting confirmation from them that the statements attributed are correct.

Two claims in particular raise significant questions, firstly a suggestion that problem was that LCF had grown too fast and were trying to recruit a finance director to file their accounts and secondly a statement that LCF had paid Surge Financial (the company that marketed and handled the customer contacts for LCF) money to underwrite the loans.

1) London Capital & Finance Problems due to lack of Finance Director

The suggestion that LCF problems were due to growing too fast and failed to file accounts because they were trying to recruit a finance director at the time of the FCA investigation seems to ignore the facts. LCF repeatedly delayed accounts 18 months ago so if a problem was identified then they had nearly 2 years to fix it. More crucially although the amount of money had increased from £60 million to £236 million the number of borrowers was essentially unchanged at 12 companies compared to 11 previously. If existing borrowers are just being handed more money then what difference would a finance director make? The issues that the FCA identified would appear to go way beyond not having a finance director when the company has entered administration and been shown to be lending money to companies associated with current or former directors of LCF.2) Surge Financial Underwrote Loans for London Capital & Finance

This is quite an intriguing suggestion that has not previously been mentioned in any information about LCF. It would be interesting to know if this is backed up or if it is a misunderstanding of the conversation from someone who isn't expert in financial matters.

If the payments made to Surge Financial were for underwriting loans instead or as well as commission for sale of bonds then it may make little difference or it could create another avenue of liability for investors to pursue.

3) Keep trading companies out of the press

This is a sensible idea in theory to avoid any negative publicity that may affect the companies that have borrowed money from LCF. However it ignores the fact that 2 of those companies are publicly listed on stock market and have already released statements of their own to the stock market and press. It also fails to recognise that those 2 companies have NOT borrowed from LCF themselves, they borrowed from a company that itself borrowed from LCF.

This statement also fails to mention the other "non trading" companies that appear to have had no activity on their accounts for the last 3-4 years

I've re-read the Facebook post several times. Each part of it defies logic. Unless the Administrator is cleaning up for the LCF directors and cronies, rather than supporting the bond-holders. That's the only explanation that makes sense

ReplyDeleteI'm trying to confirm from the administrators that this is an accurate representation of their conversation. As you say there are quite a few elements that don't make sense unless you are deliberately trying to avoid causing bondholders to panic and call their contact centre

DeleteHas S&W come back to you to verify the conversation?

ReplyDelete