What Commission Did London Capital & Finance pay for bonds?

After seeing the details for the commission & costs of Blackmore Bonds that was being paid to Surge Financial for their part in marketing/selling bonds to investors I had another look at the London Capital & Finance accounts to check the amounts being paid by them for commission.

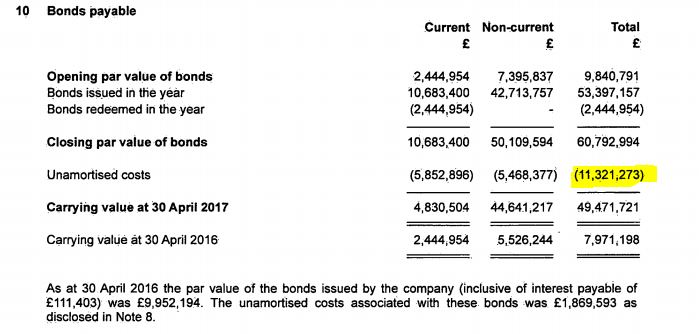

The lines to look at are the Unamortised costs and amortised costs as shown above. The costs associated costs are a staggering £11.3 million plus a separate item for amortised costs of £3.9 million so total of £15.2 million for £60.7 million of bonds.

Paying £15.2 million out of a bond issue of £60.7 million is a massive cost for commission and setting up bonds equal to 25% of the £60.7 million of bonds issued to investors.

If LCF are paying 25% of bondholder's money out in commission then they need to raise even more from their loans to cover 8% per year plus 25% to replace the reduction in capital. Just getting 8% interest back will mean bondholders are short of their capital by 25%.

In fact if LCF get 8% interest then bondholders will actually be short of interest as well as their initial capital as they will only be getting 8% interest on the 75% of their money that remains after paying the 25% commission & costs for setting up the bonds.

Unlike with Blackmore bonds we can't say that this was paid to Surge Financial but it was paid to someone - we just can't prove who at the moment.

It makes the LCF advertising even more misleading as they claimed there were no setup fees or costs. Paying 25% setup/commission is way more than any investment product I've seen before.

So far the only one of the 5 LCF advert claims that hasn't been comprehensively debunked is that you can view your investment online. As it was a fixed term and fixed amount that was a pointless facility anyway.

|

What Commission Did London Capital & Finance pay for bonds? |

Comments

Post a Comment