Detailed Analysis of CV Resorts Ltd - London Capital & Finance - Have any of their loans defaulted?

London Capital & Finance repeatedly claim that their loans have never defaulted. Depending on the terms & conditions of those loans it may be technically true but looking at the accounts of two of the companies they seem to have loaned money to it is rather misleading.

According to the latest published accounts to 30 April 2017 (more recent accounts have been delayed due to LCF using a loophole to avoid publication) London Capital & Finance have only 11 borrowers up from 6 in 2016. With a loan book valued at £58m that's an average of over £5 million per loan. This is an average, it's possible that some were much higher value loans. Were London Capital & Finance bond holders aware that there was such a small pool of borrowers with loans as this significantly increases the risk?

LEISURE & TOURISM DEVELOPMENTS LIMITED, Company number 09324527 made a loss of over £10 million in 2017 and now has negative shareholders' funds. This is collateral for loans made by LCF which appear to total £41 million. If the assets of the company are negative how can LCF claim to be asset backed?

According to the latest published accounts to 30 April 2017 (more recent accounts have been delayed due to LCF using a loophole to avoid publication) London Capital & Finance have only 11 borrowers up from 6 in 2016. With a loan book valued at £58m that's an average of over £5 million per loan. This is an average, it's possible that some were much higher value loans. Were London Capital & Finance bond holders aware that there was such a small pool of borrowers with loans as this significantly increases the risk?

|

| London Capital & Finance -How many loans? |

If the terms of your loan say that you don't need to make any interest payments or payments of capital then I guess you're never in default but how can London Capital & Finance make interest payments to bondholders if they're not receiving any interest payments from their borrowers? Could they be using money from new investors to do that?

One other company that London Capital & Finance seems to have lent money to is CV Resorts Ltd which is run by the same director as London Capital & Finance. It's hard to know exactly what has been loaned to which company as the accounts are not detailed sufficiently but London Capital & Finance and linked company Cape Verde Support Ltd are the only companies that have a charge on the accounts of CV Resorts and there is a secured debt showing in the accounts of £5.7 million.

This loan has sat doing nothing for 4 years. How can they pay interest of 12-20% on it to LCF when it is earning nothing? No interest payments have been made to LCF over the 4 year period and the company is not trading. It makes no sense at all if LCF were really lending money!

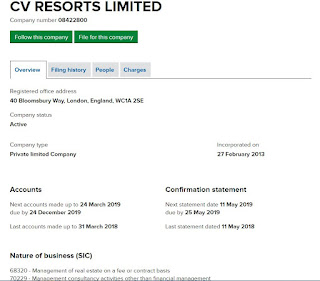

CV Resorts Ltd was registered as a company in 2013

One other company that London Capital & Finance seems to have lent money to is CV Resorts Ltd which is run by the same director as London Capital & Finance. It's hard to know exactly what has been loaned to which company as the accounts are not detailed sufficiently but London Capital & Finance and linked company Cape Verde Support Ltd are the only companies that have a charge on the accounts of CV Resorts and there is a secured debt showing in the accounts of £5.7 million.

This loan has sat doing nothing for 4 years. How can they pay interest of 12-20% on it to LCF when it is earning nothing? No interest payments have been made to LCF over the 4 year period and the company is not trading. It makes no sense at all if LCF were really lending money!

Most importantly in the time since the loan was made in 2015 until the latest accounts, NO interest payments or capital payments have been made. LCF are not getting a return from this money!

CV Resorts Ltd was registered as a company in 2013

|

| CV Resorts Ltd company registration |

The only director of CV Resorts is Robert Mannering Sedgwick whose name crops up repeatedly in connection with London Capital & Finance. He was suspended for a year in 2018 for his role in a carbon credits scam. He admitted to involving himself and his firm in four dubious investment schemes and also allowing the firm’s bank account to be used a banking facility where there was no underlying transaction

|

| The only director of CV Resorts is Robert Mannering Sedgewick |

Another set of accounts were filed in September 2015 showing a revaluation item of £23 million and a loan of £5.7 million. There appears to have been no other activity from the company - no trading or any other income. The SIC code for the company shows management activities, it does not show codes that would indicate ownership of any properties.

From the asset charges on the Companies House website it appears that this loan was made to CV Resorts Ltd by another company London Group Support which is registered at the same address as CV Resorts and also London Capital & Finance.

Curiously the asset charge was only made on 15 November 2015 yet the money had already been loaned to CV Resorts by that point and had appeared in their accounts of September 2015. You would expect that the money would not be handed over until it had been secured as it creates quite a big risk that the documents might not be signed.

The accounts for 2016, 2017 and 2018 show absolutely no activity. The balance sheet is identical across all 3 years meaning the company had not traded in any way. It appears from this information that as in the Monty Python sketch the company is a Norwegian Blue - a rather dead parrot. Why would any company lend money to a non trading company with no assets?

|

| CV Resorts accounts Sept 2015 showing debt and revaluation |

Curiously the asset charge was only made on 15 November 2015 yet the money had already been loaned to CV Resorts by that point and had appeared in their accounts of September 2015. You would expect that the money would not be handed over until it had been secured as it creates quite a big risk that the documents might not be signed.

The accounts for 2016, 2017 and 2018 show absolutely no activity. The balance sheet is identical across all 3 years meaning the company had not traded in any way. It appears from this information that as in the Monty Python sketch the company is a Norwegian Blue - a rather dead parrot. Why would any company lend money to a non trading company with no assets?

Due to the nature of the micro entity company accounts submitted details are scarce but in 2017 it looks like the debt was refinanced into London Capital & Finance who now have a charge against the company. Just before the London Capital & Finance charge was applied on 12 May 2017 another charge was granted to another linked company Cape Verde Support Limited again registered at the same address.

The company appears to have no assets as the balance sheet was £10,000. For some reason during 2015 the company assets were revalued and increased by £23 million. Presumably this was then used as collateral but appears to have come from thin air.

|

| CV Resorts revaluation accounts from 2015 |

In the 2018 accounts CV Resorts have now said that this revaluation is impaired but have not quantified the amount. This would appear to be a precursor to writing off amounts of value in the company.

|

| CV Resorts Impairment |

It raises the massive question marks over why London Capital & Finance lent money to CV Resorts Limited when the company has never traded and has assets that appear to have been inflated before the loan was made and are now being reduced.

Comments

Post a Comment