London Capital Finance - What happens next?

Important Information for LCF Investors/Bond Holders

Quite a few investors are asking what happens next with London capital finance but are unclear about the processes involved. It's important to remember that the bonds issued by LCF are unregulated. This sadly means you have no rights to claim with the FSCS and no rights to complain to the Financial Ombudsman Service (FOS) which was probably not made very clear in the marketing material. If you want to claim against LCF you will need to instruct a solicitor. |

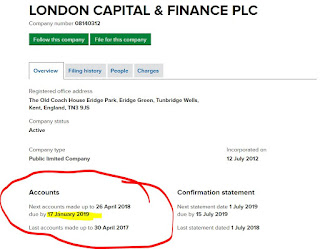

| London Capital & Finance accounts overdue - new date |

Key Dates

Unless any FCA updates come out the key next date is 17th January 2019. This is the deadline for LCF to publish their long delayed accounts for 2018. They've already used a loophole to avoid publishing them once, will they do so again or will we get to find out how much money is there and how many loans they have made? Last year the loophole was used several times to delay the accounts being shown.

Owner of LCF called London Financial Group is also due to publish accounts on 26 January 2019.

Owner of LCF called London Financial Group is also due to publish accounts on 26 January 2019.

Account Login Balances - Investment Secure?

Someone on a forum seems to be reassured that they can still log in to the LCF website and it's still showing the balance of their bonds. Unfortunately this number is meaningless. I'm sure the website visibility was designed as a gimmick to convince bondholders that their money was safe when in reality it is at risk regardless of whether any fraud has been carried out.

The truth is that a number on a screen is no guarantee of any money being returned to them as it could disappear at any point before the end date and the money being in their bank account. It's an unregulated investment so there is no obligation to be true. As listed in the promotional material your capital is at risk so you may not get back what you put in. It would be the same as looking at your S&S ISA account each day except that it valued daily, the LCF loan is purely showing what you put in, it cannot show what you may get back as there is no valuation process.

Asset Backed Security - It's all ok right?

LCF claimed that loans were only made to companies after a detailed analysis. This is clearly untrue as money was given to companies with no trading history and others that were brand new with no apparent assets. As a result the asset backed claim should be taken with a pinch of salt.

It's important to remember that the assets of LCF are minimal other than loans made. They have virtually no employees, all their call centre staff are outsourced to Surge financial so any comments from agents about LCF trading are not from anyone with knowledge of the company or employed by London Capital Finance. They are just reading from a script of answers. Again it's crucial to understand that this is not a regulated product so the same rules that banks need to follow for example do not apply.

FCA investigation

The FCA investigation may take some time to complete but if the result is that LCF has gone bust then FCA will not be taking any action to recover funds for investors. This is an unregulated investment so they have no role in recovery. Investors will need to take legal action against the company to get money back.

Comments

Post a Comment