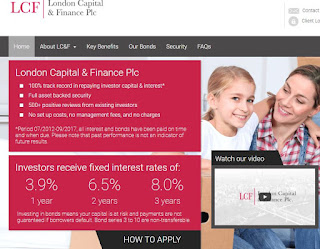

Do Global Security Trustees Reduce Risk for London Capital Finance?

London Capital & Finance repeatedly quote that the loans they make are secured against assets and that they are protected by Global Security Trustees for London Capital Finance to claim that they are safe.

What investors may not realise is that as of April 2018 Global Security Trustees has been sold to a Malta based company so all their assets and control of LCF assets are now owned by them. Let's just hope that a no deal Brexit doesn't happen as there will almost certainly be no jurisdiction once we leave the EU.

Other companies with a security trustee setup that have failed how shown how ineffective that can be. Providence Bonds and Secured Energy bonds are both failed unregulated investment schemes that we supposedly protected by a trustee. When they failed the trustee had no assets to distribute so investors received nothing. It's possible they may get a payout via FCA/FSCS due to the way the bonds were promoted by a regulated company but the security trustee made no difference to this outcome.

What investors may not realise is that as of April 2018 Global Security Trustees has been sold to a Malta based company so all their assets and control of LCF assets are now owned by them. Let's just hope that a no deal Brexit doesn't happen as there will almost certainly be no jurisdiction once we leave the EU.

Other companies with a security trustee setup that have failed how shown how ineffective that can be. Providence Bonds and Secured Energy bonds are both failed unregulated investment schemes that we supposedly protected by a trustee. When they failed the trustee had no assets to distribute so investors received nothing. It's possible they may get a payout via FCA/FSCS due to the way the bonds were promoted by a regulated company but the security trustee made no difference to this outcome.

|

| LCF - Global Security Trustees for London Capital Finance |

Comments

Post a Comment